Navigating Lawful Seas: Recognizing Securities Fraud Class Actions

Navigating Lawful Seas: Recognizing Securities Fraud Class Actions

Blog Article

Navigating Stocks Scams Course Actions: Fundamental Info and Legal Considerations

Stocks fraudulence class activities can be difficult and complicated lawful proceedings, needing an extensive understanding of the important info and lawful factors to consider entailed. From developing the elements of evidence to navigating the possible problems and settlements, complainants need to be outfitted with the right methods to properly browse this intricate surface. In this conversation, we will check out the critical aspects of securities fraudulence class activities, supplying insights right into the lawful factors to consider that complainants should remember. By clarifying the complexities of this field, we intend to outfit readers with the required knowledge to browse these course actions effectively.

Understanding Securities Fraudulence Course Actions

Understanding Securities Scams Class Actions is crucial for financiers and lawyers alike, as these complicated legal proceedings play an important role in holding fraudulent business responsible and safeguarding the legal rights of shareholders. Securities scams refers to misleading practices in the financial markets, where business or individuals misstate material realities or participate in various other unlawful activities to manipulate supply rates. When such scams occurs widespread and impacts a substantial number of investors, a class activity legal action might be started.

Stocks Scams Course Actions enable a group of investors who have actually experienced financial losses as a result of the illegal activities of a business to join with each other and collectively seek compensation. These course activities simplify the lawsuits procedure, as it would certainly be not practical for each individual financier to submit a different lawsuit. By consolidating claims, course actions allow investors to merge their resources and raise their chances of holding the deceitful company answerable.

To bring an effective safeties fraudulence class activity, particular aspects should be pleased. These normally include confirming that the accused made misleading or incorrect declarations, that these statements influenced the supply price, which capitalists endured monetary losses because of this. Additionally, the lead complainant-- the agent of the course-- have to show that they are effectively standing for the interests of the class participants.

Comprehending the details of safety and securities fraud course actions is important for financiers, as it aids them recognize possible warnings and make informed decisions concerning their investments. For lawful professionals, a deep understanding of these procedures is essential for efficiently looking for and representing customers justice on their part.

Components of Evidence in Securities Scams Situations

Stocks scams class actions need the fulfillment of specific components of proof in order to develop a solid case against fraudulent companies and seek compensation on part of damaged investors. These aspects of proof are essential for plaintiffs to show that the accused taken part in deceptive conduct which the complainants suffered real injury as an outcome.

One crucial component of proof in securities fraud instances is the existence of material misrepresentations or omissions. Plaintiffs should reveal that the defendant made false declarations or fallen short to reveal vital details, which these omissions or misstatements were material, indicating they would have affected an affordable financier's decision-making process.

One more crucial element is scienter, which refers to the offender's intent to manipulate the market or trick. Plaintiffs need to demonstrate that the defendant acted with expertise of the falsity of their declarations or with careless neglect for the truth.

In addition, complainants should establish that they depend on the offender's omissions or misstatements, which this reliance was sensible. They have to reveal that they would not have actually bought or offered the protections concerned if they had understood the truth.

Lastly, complainants need to demonstrate that they suffered actual economic loss as a result of the offender's fraudulent conduct. This can consist of a decrease read the article in the worth of their financial investments or various other financial harm.

Legal Factors To Consider for Complainants in Class Activities

When pursuing a protections fraudulence course activity, plaintiffs have to meticulously consider numerous legal factors to consider in order to construct a solid instance and seek payment for the injury caused by fraudulent conduct. These Source lawful considerations play an essential function in determining the success of the suit and the prospective healing for the complainants.

One crucial lawful consideration for plaintiffs is picking the right lead complainant, additionally known as the course representative. The lead plaintiff is accountable for standing for the passions of the whole class and should have a sufficient stake in the outcome of the instance. Courts typically take into consideration aspects such as financial passion, understanding of the situation, and capacity to actively take part in the lawsuits procedure when designating a lead complainant.

In addition, plaintiffs need to carefully assess the relevant law of constraints. Stocks fraud class activities must be filed within a specific duration after the fraudulence is found or should have been discovered by the plaintiffs. Stopping working to submit within the statutory duration can result in the termination of the case. For that reason, plaintiffs should be thorough in adhering and determining to the relevant due dates.

Furthermore, plaintiffs have to consider the jurisdiction in which to file the suit. Various jurisdictions have varying laws and guidelines regarding safeties fraud, and selecting the right forum can substantially impact the end result of the situation - Securities Fraud Class Actions. Variables such as beneficial legal criteria, criteria, and jury pools need to be considered when deciding where to file the suit.

Prospective Problems and Negotiations in Stocks Scams Course Actions

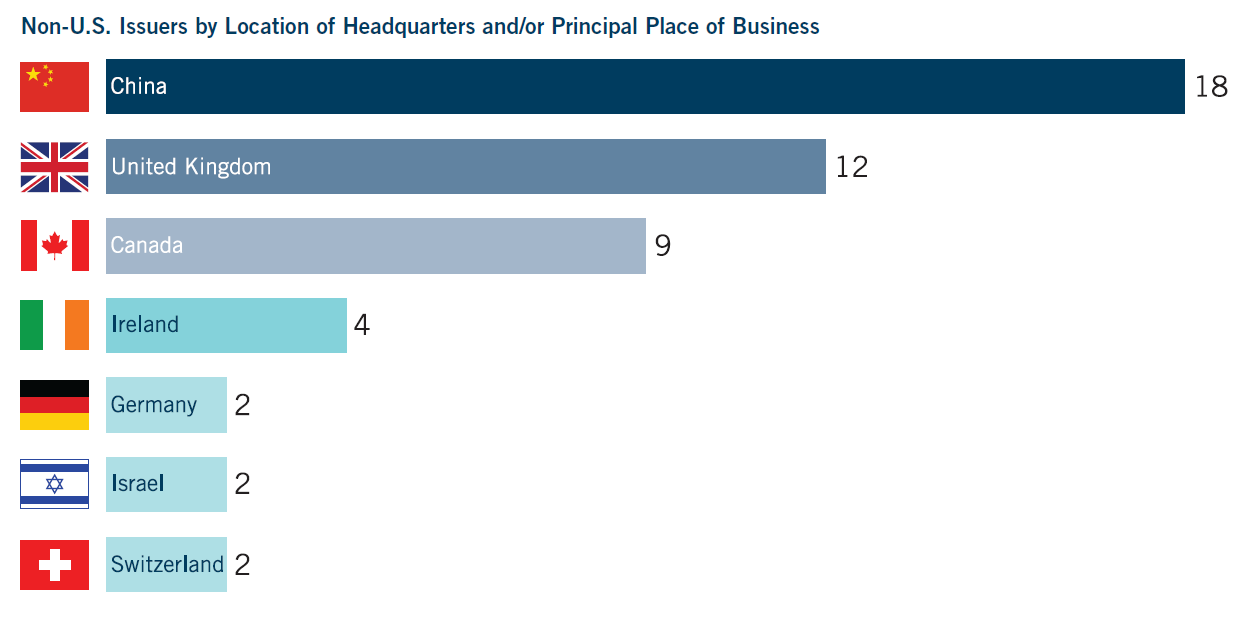

The number of damaged financiers likewise plays a considerable duty in establishing the prospective problems and negotiations. The larger the number of capitalists entailed, the greater the potential problems may be.

As soon as liability is established, securities fraudulence class activities frequently cause settlements as opposed to going to trial. Negotiations can offer payment to the affected financiers and prevent the expenses and unpredictabilities connected with a trial. The negotiation quantity can differ significantly relying on the certain scenarios of the case, consisting of the toughness of the plaintiffs' claims, the financial sources of the offender, and the readiness of both parties to get to a resolution.

Strategies for Navigating Securities Fraudulence Lawsuits

One essential facet to consider when browsing securities fraud lawsuits is creating effective legal methods. For plaintiffs, it is crucial to carefully explore and collect evidence to sustain their cases of safety and securities fraud. Overall, creating efficient legal methods is vital for both complainants and offenders in protections scams lawsuits as it can considerably affect the end result of the situation.

Conclusion

To conclude, browsing safeties scams class activities requires a detailed understanding of the components of proof, lawful factors to consider, prospective problems, and settlement approaches. Complainants in these cases need to very carefully assess their insurance claims and gather enough proof to support their accusations. Successful navigating of securities fraud litigation can cause positive outcomes for plaintiffs, offering them with the possibility to look for settlement for their losses.

Stocks fraudulence course actions can be difficult and intricate legal proceedings, calling for a comprehensive understanding of the necessary info and legal considerations included. In this conversation, we will certainly discover the crucial elements of securities fraudulence course activities, supplying insights into the lawful considerations that plaintiffs ought to bear in mind. Securities Fraud Class Actions.Understanding Stocks Fraud Class Actions is important for investors and legal experts alike, as these complicated lawful proceedings play an essential role in holding deceptive firms answerable and protecting the legal rights of shareholders. Stocks fraudulence course activities must be filed within a specific timeframe after the scams is found or should have been discovered by the complainants.Possible problems and negotiations in safeties fraudulence course activities depend on different factors, including the extent of the fraud, the number of damaged financiers, and the toughness of the evidence presented

Report this page